What is a payment gateway?

Payment Gateway Malaysia is a service used by the payment merchant that allows businesses to securely process transactions from the customers. When a customer makes a purchase on an e-commerce website, the online gateway payment processes the transaction by communicating with the customer’s bank and the merchant’s payment processor, and then sending back a confirmation or a decline message to the merchant’s website.

The payment gateways encrypts the sensitive information, such as credit card numbers and check the customer has enough money in their account to cover the purchase. Payment gateways are a crucial part of electronic commerce infrastructure, allowing merchants and customers to safely conduct transactions online.

Best Payment Gateway malaysia List

Here is a list of the top gateway for online payment in Malaysia:

- Senang Pay

- Billplz

- eGHL

- iPay88

- Stripe

Factors in Choosing a Payment Gateway

When comparing gateway online payment services providers in Malaysia, keep the following five things in mind:

- Payment Method

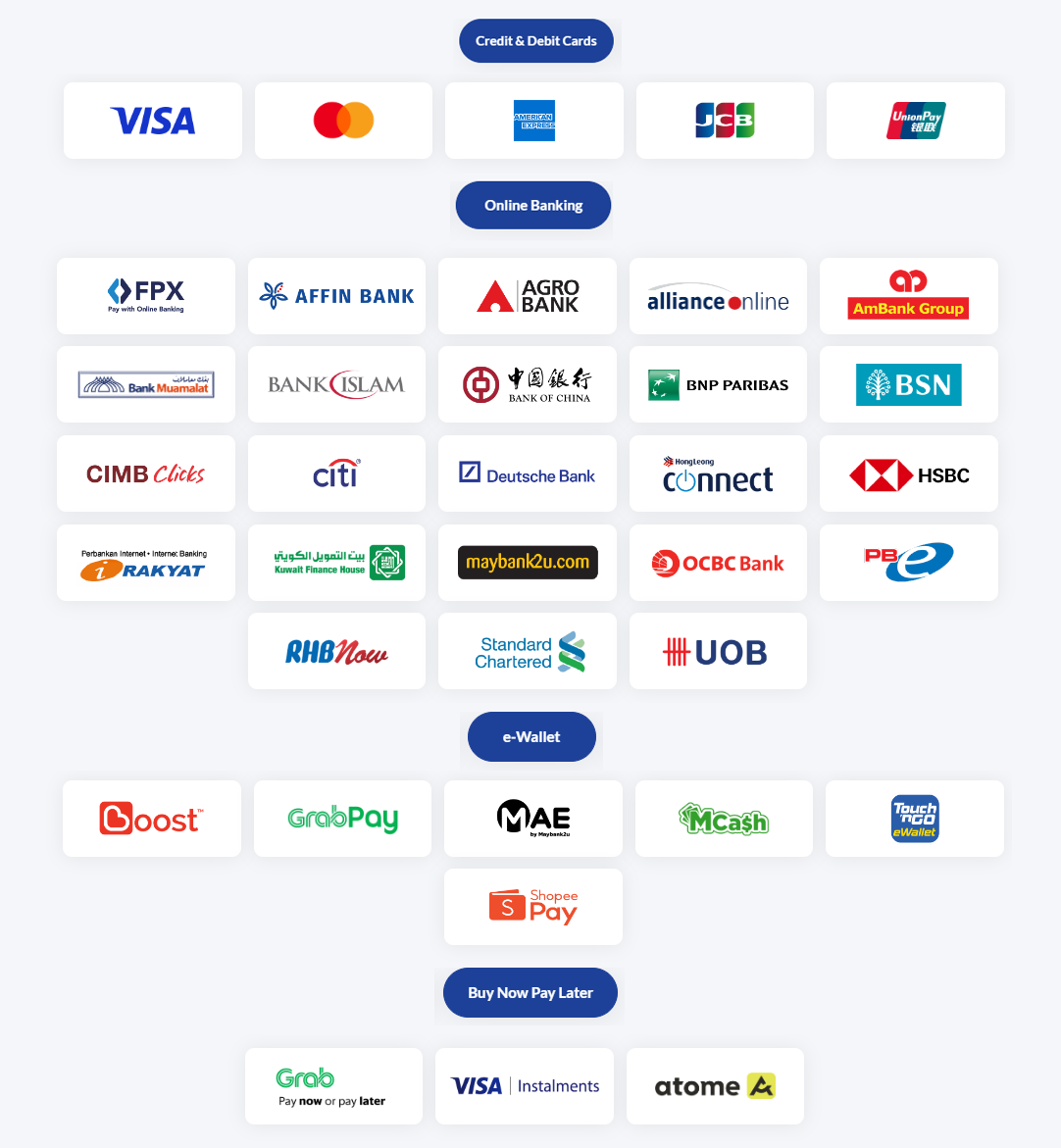

A payment method is a way for customers to pay for the services. There are different types of payment methods, including:- Credit/debit cards :

Customers can use a credit or debit card provided by a financial institution to make payments utilising. - Online banking :

This method allows customers to make payments using online banking services offered by banks in Malaysia such as Affin Bank, AmBank, Bank Islam, Bank Rakyat, Bank Muamalat, CIMB Bank, Hong Leong Bank, Maybank, OCBC Bank, Public Bank, RHB, Standard Chartered,UOB and other. - E-wallets:

This is a digital version of a physical wallet and enables customers to make payments. The most popular e-wallets in malaysia include Touch ‘n Go eWallet, Boost, GrabPay, shopee pay and other. - Buy Now Pay Later(BNPL):

Buy Now Pay Later (BNPL) is a type of installment plan offered by some retailers and e-commerce sites, which allows customers to make a purchase without paying for it upfront. Many retailers and service providers offer credit card installment plans, which allow customers to pay for their purchase in smaller, scheduled payments over time using their credit card. The example of an installment which is switch installment, iphone installment, laptop installment plan and other.

- Credit/debit cards :

- Fees

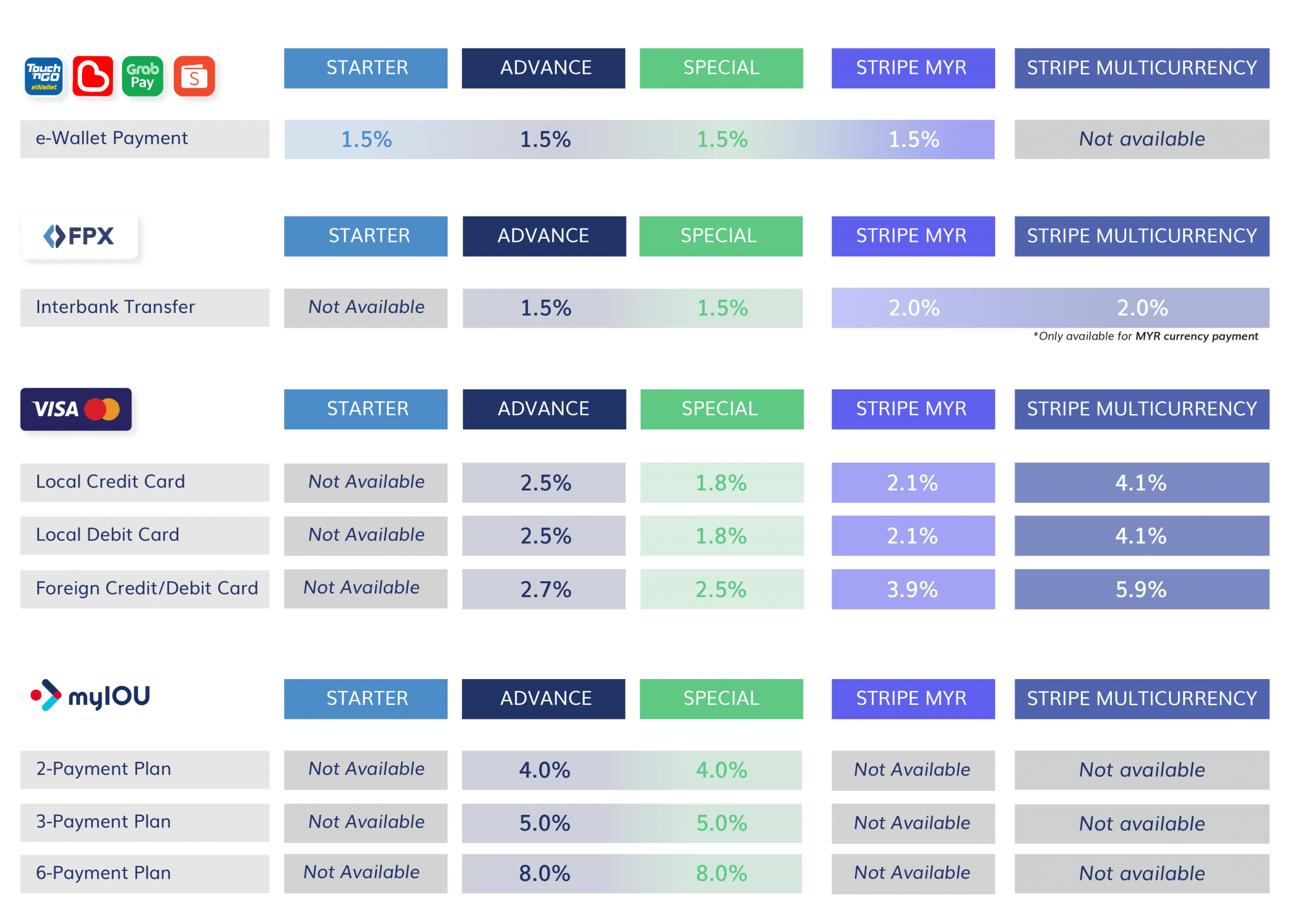

The customers must evaluate each provider’s transaction fees and other costs. Following is a list of the several types of fees that often include:- Transaction fee (MDR) :

Transaction fee, also known as Merchant Discount Rate (MDR), is a fee charged by payment gateway malaysia on every successful transaction. In general, it’s common for the merchant charge rate for each transaction to range from 1% to 4%, although it can be higher or lower depending. - Setup fee :

A setup fee, also known as an activation fee, is a one-time fee that some banks may charge merchants for setting up and activating a merchant account. - Annual fee :

It’s the yearly payment to keep the account active. This annual fee also will include the cost of maintaining the merchant account.

- Transaction fee (MDR) :

- Application Approval Time

To ensure that the website can go live in the anticipated time frame, the application clearance time is crucial. It can take a few days to a few weeks to submit an application for a payment gateway malaysia account. - Secure payment processing

PCI-DSS (Payment Card Industry Data Security Standards) is a set of security standards established by the major credit card companies (Visa, Mastercard, American Express, etc.) to protect against credit card fraud.By choosing a payment gateway provider that offers secure payment processing with PCI-DSS compliance, merchants can ensure that they are following industry best practices for protecting sensitive customer data, and reducing their risk of credit card fraud.

Malaysia payment gateway comparison

Payment Gateway Malaysia Comparison in detail:

| Provider | Senang Pay | Biliplz | eGHL | iPay88 | Stripe |

|---|---|---|---|---|---|

| Setup Fee | Free | Basic Package : FreeBasic Package : Free |

RM 499 | SOHO Plan: RM 488 SME Plan: RM 488 |

Free |

| Annual Fee | Starter Package : RM300 per year Advance Package : RM450 Special Package : RM1500 | Basic Package : FreeStandard Package : Rm5300 | RM25 for transaction volume less than RM 15,000 per/month; waived if monthly volume exceed RM15,000 | SOHO Plan : WaivedSME Plan:RM 500(Waived from second year onwards) | Free |

| Credit/ Debit Card | Starter Package : Not AvailableAdvance Package (Mastercard / Visa) :2.5% per transaction (Local)2.7% per transaction (Foreign)Special Package (Mastercard / Visa) :1.8% per transaction(Local)2.5% per transaction (Foriegn) | Basic Package (Mastercard / Visa) : 2.2% per transaction (Local)Standard Package (Mastercard / Visa) :1.8% per transaction (Local)Foreign-issued(Mastercard / Visa) : Contact [email protected] | 2.5% MYR per processing (+ 1 – 2% non-MYR processing, + MYR 0.50 for ticket sizeless than MYR 40.00) | SOHO Plan :Not availableSME Plan : >3.0% per transaction (Visa/Mastercard Credit card)2.5% per transaction (Debit card)2.7% per transaction (UnionPay Credit/Debit card) | 3.0%+ RM1.00 per successful card charge +2% if currency conversion is required |

| Internet Banking (FPX) | Starter Package : Not availableAdvance Package : 1.5% per transactionSpecial Package :1.5% per transaction | Basic Package : RM1.00 per transactionStandard Package : RM0.5 Per transaction | 2.8% or Minimum RM0.60 per transaction | SOHO Plan: 3.0% per transaction or minimum *RM 0.60 whichever is higher for onlinebanking (e-debit)SME Plan: 2.7% per transaction or minimum *RM 0.60 whichever is higher for onlinebanking (e-debit) | 3.0%+ RM 1.00 per paid transaction*Fees exclude SST. |

| E-wallet | Starter/ Advance / Special Package : 1.5% per transaction (ShoppeePay, TouchnGo pay,GrabPay, Boost) | Maybank QRPay (Basic / Standard Package):1% per transactionShopeePay (Basic / Standard Package) : 1.1% per transactionTouchnGoPay (Basic / Standard Package) : 1.2% per transactionGrabPay (Basic / Standard Package) : 1.2% per transactionBoost (Basic / Standard Package) :1.4% per transaction | GrabPay,Touch ‘n Go, Boost, MCash or ShopeePay : 1.5% per transactionMaybank2u: 1.0% per transaction | SOHO Plan : 1.0% per transaction (Boost wallet)1.5% per transaction (GrabPay, Touch ‘n Go)2.0% per transaction (KipplePay)SME Plan : 1.0% per transaction (Boost wallet)1.2% per transaction (VCash Wallet)1.5% per transaction (GrabPay, Touch ‘n Go)2.0% per transaction (Kipple Pay) | Alipay2.9% + RM1.00 per transactionGrabPay3.0% per transaction |

| BuyNow Pay Later(BNPL) | Starter Package: Not availableAdvance/ Special Package (MyIOU) : 2 payment plan – 4% for total payment3 payment plan – 5% for total payment6 payment plan – 8% for total payment |

Not Available | Pay Later By Grab/ Visa Instalment / Atome | Pay Later By Grab/ Atome / MobyPAY | Not Available |

| Supported Currencies | MYR * USD, EUR, IDR, THB and more Refer to Senang Pay Stripe Package |

MYR | MYR (support multi currencies) |

MYR | International Currencies |

| Minimum Settlement | Min RM100 | Min RM0.01 | No Minimum withdrawal amount | RM100 | RM5 |

| Application Approval Time | 1-14 day | Around 14 days | Credit Card: within 2 monthsOnline Banking: 7 – 14 working days | Internet Bank Transfer : Within 14 working daysCredit Card Gateway:2 to 3 months | Immediate |

*Please visit the official website for the most recent updates as this table is solely for reference.

Senang Pay

*Source on the Senang Pay Website

SenangPay is a payment gateway service provider in Malaysia and managed by Simplepay Gateway Sdn Bhd. They support a wide range of payment methods, including credit/debit cards, FPX payment, and e-wallets.

Features:

- Easy integration with the most popular e-commerce platforms

- Secure payment processing with PCI-DSS compliance

- Low transaction fees

- Multi-Currency support

- Support Installment plan

SenangPay Review

One of the great payment gateway that I met in Malaysia. Quick response and efficiency help out to solve my problem.

*From the Senang pay google review

Checking the senangpay pricing : https://senangpay.my/fee-costing-features/

Address : 19, Jalan Pengaturcara U1/51a, Kawasan Perindustrian Temasya, 40150 Shah Alam, Selangor

Contact Detail : 03-2771 2707

Operating Hours : Monday- Friday (9:00am – 5:30pm)

Billplz

*Source on the Billplz Website

According to statistics from Bank Negara, Billplz is one of the most popular online gateway payment options in Malaysia because of its low transaction fees and fast settlement time. They support multiple online banking options ,credit/debit cards and e-wallets.

Features:

- Easy integration with the most popular e-commerce platforms

- Secure payment processing with PCI-DSS compliance

- Instant notification and auto-update on payment status

- Low transaction fees

- Friendly user interface

- Less withdrawal amount

Billplz Review

Explanations are good and very clear and good assist regarding the products and subscriptions

Checking the Billplz pricing : https://www.billplz.com/pricing

Address : K03-11-13, Level 11, Tower 3 UOA Business Park, 40150 Shah Alam, Selangor

Contact Detail : 03-5626 0056

Operating Hours : Monday- Friday (9:00am – 5:00pm)

eGHL

*Source on the eGHL Website

eGHL (Electronic Global Holdings Limited) is a product of eGHL Systems Berhad, a company that provides payment solutions for e-commerce in Southeast Asia. eGHL combines multiple well-known payment channels in Southeast Asia into one integrated payment platform, which allows merchants to easily accept payments from customers through various methods including credit and debit cards, online banking and e-wallets.

Features:

- Easy integration with the most popular e-commerce platforms

- Secure payment processing with PCI-DSS compliance

- Instant notification and auto update on payment status

- Multi-Currency support

- Support Installment plan

- Less withdrawal amount

Checking the eGHL pricing : https://www.ghl.com/e-commerce

Address : C-G-15, Block C, Jalan Dataran SD1, Dataran SD, PJU 9, Bandar Sri Damansara, 52200 Kuala Lumpur, Malaysia.

Contact Detail : +603 6286 5222

Operating Hours : Monday- Friday (9:00am – 6:00pm)

iPay88

*Source on the iPay88 Website

iPay88 is a leading payment gateway provider in South East Asia, owned by The Mobile88 Group of Companies. They provide secure, reliable, and efficient payment solutions for online merchants across the region, including Malaysia, Singapore, Indonesia, and Philippines.The Ipay88 fee is an affordable rate. It offers a wide range of payment options including credit/debit cards, online banking, and e-wallets.

Features:

- Easy integration with most popular e-commerce platforms

- Secure payment processing with PCI-DSS compliance

- Instant notification and auto update on payment status

- Support Installment plan

iPay 88 Review

Our experience with iPay88 has been very good and seamless so far. Hardly any major tech issues and if there is any, it is dealt with swiftly.

Checking the iPay88 pricing : https://www.ipay88.com/

Address : Suite 2B-20-1, 20th Floor, Block 2B, Plaza Sentral, Jalan Stesen Sentral 5, 50470 Wilayah Persekutuan, Federal Territory of Kuala Lumpur

Contact Detail : 03-2261 4668

Operating Hours : Monday- Friday (9:00am – 6:00pm)

Stripe

*Source on the Stripe Website

Stripe is an American-based company that provides an international payment gateways service. Stripe allows businesses to easily accept payments from customers around the world via credit and debit cards, bank transfers, and other digital wallets. They allow merchants to accept payments from customers via a variety of methods, including credit and debit cards, bank transfers, and other digital wallets.

Features:

- Easy integration with the most popular e-commerce platforms

- Secure payment processing with PCI-DSS compliance

- Instant notification and auto update on payment status

- Multi-Currency support

- Instant settlement

Checking the Stripe pricing : https://stripe.com/en-my/pricing

Summary malaysia payment gateway comparison

In conclusion, choosing a payment gateway is not as easy as it seems. Online payment and online banking have indeed transformed the way consumers shop, buy, and pay, as well as the way businesses conduct their transactions. These technologies have made it easier and more convenient for both consumers and businesses to make financial transactions, and have also increased the security and efficiency of these transactions.

At Rebrand Malaysia, we value your patronage and appreciate that you took the time to read one of our article. We hope that you found it inspiring and informative as we are striving to provide the latest business insights and trends in the digital marketing landscape that Malaysian Businesses should not miss.

The landscape of marketing is ever changing with new technologies and platforms emerging frequently. It can be challenging for businesses to keep up with the latest trends and adapt their marketing strategies accordingly.

Rebrand Malaysia specializes in Web Design / digital marketing solutions including web design, ecommerce, digital marketing, content writing, SEO, domain and hosting. We’ve successfully helped more than 250+ clients within Malaysia & Singapore in achieving their business goals and objectives.

Check out our portfolio: www.rebrand.com.my/portfolio

Get a FREE 30-minute consultation with Rebrand Malaysia Now!

Subscribe to our newsletter to always be up-to-date with the latest online marketing trend!

Call us at : 011-3957 0709

Email us at: [email protected]

WhatsApp: https://wa.link/a2qbik

- 5 Most Popular Payment Gateway Malaysia in 2024 - June 12, 2024

- Graphic Design Company Malaysia : Storytelling Through Design - June 7, 2024

- How To Choose The Best Fit Accounting Software Malaysia? - May 13, 2024